SWDC Industry Sector Dashboard

You can navigate the dashboard by clicking the tabs, by using the slicers and, for example, by clicking on specific industries. If you want to filter by more than one factor you use the "shift" + "ctrl" buttons.

The above dashboard allows the user to explore profiles of four of the South West Development Commission’s (SWDC) strategic industry sectors: Mining & METS, Advanced Manufacturing, Energy, and Creative & Digital Technologies.

It displays information on each industry, including:

Regional, sub‑regional and LGA characteristics of each industry sector.

Count of business and number of employees within each industry sector.

The estimated economic contribution of each industry sector.

Information on key major firms relevant to the profiled industry sectors.

The dashboard provides insights on how these four industry sectors can be leveraged to achieve the SWDC’s vision: "By 2050, the South West is an internationally-recognised region of excellence for high quality products and tourism experiences with a reputation for innovation and advanced manufacturing technologies in industry. That quality of life for South West residents is no less than that of metropolitan areas, with comparable employment opportunities, access to services and vibrant communities to achieve an enviable work/life balance."

Priority Industry Sector Interrelationships in the South West Region

Each of the four industry sectors currently operate independently of each other. Moving forward, sustainable comparative advantages could be created for the South West as these four industries begin to work together to solve problems jointly.

Figure 1 indicates how this shift is beginning to occur. Creative & Digital Technology Industries and Advanced Manufacturing play a critical role for other industry sectors in the South West as:

Creative & Digital Technologies create access to new technologies for other industry sectors, leading to increased innovation.

Advanced Manufacturing provides capabilities that allow traditional manufacturing to increase productivity and pivot towards new opportunities and markets.

The growth-driving role of both Creative & Digital Technologies Industries and Advanced Manufacturing will only become more critical to the future performance of all the South West’s strategic industry sectors.

Figure 1: Industry sector interrelationships in the South West.

Source: FAR Lane 2021.

Legend

Blue = Enabling Strategic Industry Sector

Red = Other Strategic Industry

A separate category of critical Supporting Industries has also been recognised - acting as growth catalysts for the four industry sectors. This includes; logistics, specialised business services, and IT support. These industries are highly knowledge-intensive and differ from typical population-driven or business-to-business industries in the service sector (also present in the South West).

Regional Specialisations

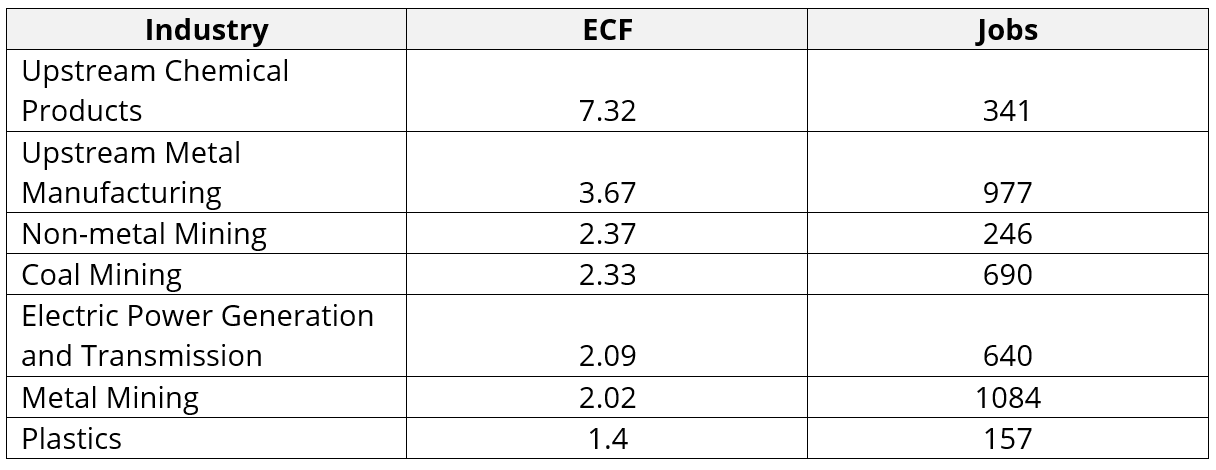

Employment Concentration Factor (ECF) measures employment in a given industry within a specified geographical region against a national benchmark. By employing more workers than the national average, more goods and services are being produced than the region can consume. Therefore, ECF is a proxy calculation to show which industries are traded industries (i.e. producing exports).

This is important, as traded industries are associated with higher average wages, greater potential for growth, and higher productivity compared to local industries. Therefore, traded industries are an important focus for regional economic development. In contrast, local industries serve the local market and play a lesser role in creating economic growth in the region.

ECF figures should be understood as follows:

An ECF greater than 1.25 indicates the local economy is exporting goods in that particular industry.

An ECF close to 1.0 implies that the economy is self-sufficient.

An ECF less than 1.0 implies that the local economy imports goods in that industry from elsewhere in the region.

Of the industries being examined, the following show high ECF and, therefore, key exports industries for the South West.

Figure 2: Strategic industry sector analysis of the South West.

Source: Census 2016.

Other industries in the South West with high ECF not considered to sit within the subject industry sectors considered in this work are predominantly in primary industries, food processing, and tourism.

ECF can also be examined by Local Government Areas (LGA) to show intra-regional specialisation. The following LGAs show notably high ECFs and job numbers relating to the four strategic industry sectors.

Figure 3: Strategic industry sector analysis by LGA and ECF.

Source: Census 2016.

The high ECFs are consistent with key industrial precincts within the South West, including lithium mining in Greenbushes, METS manufacturing in the Greater Bunbury area, coal mining and electricity generation in Collie, and METS and chemical manufacturing at Kemerton.

The South West’s specialisation in METS and chemical manufacturing is particularly important as it highlights the region’s competitive advantages. These industries can potentially be leveraged to create jobs and growth by tapping export markets or meeting new demands for sovereign capability (see below).

Creative & Digital Industries are not represented in the above lists. They are less likely to co‑locate than the other industry sectors as their outputs are often digital and can be distributed easily online.

Image 1: Manufacturing - South West Development Commission.

Source: South West Development Commission 2021.

Industry Sector Breakdowns

Mining & METS is a key economic driver of the region, being valued at $2.85 billion in 2019 and home to one of the biggest lithium mines in the world. A key future objective is to build on the region's mineral resources, downstream processing, mining equipment and technology services capabilities to further leverage exports.

Mining, defined here as the extraction and shipment of mineral resources, is a key driver of the METS, energy, and advanced manufacturing sectors in the South West, as well as individual mine sites (see map) and key geographic mining hubs which include Kemerton, Collie, and the Bunbury port.

Key drivers in the mining space in the South West include; Fortesque, South 32, Premier Coal, Griffin Coal, Doral, Cristal, Talison Lithium, Worsley Alumina, Iluka, and Tronox.

METS firms are businesses that provide technology and services to mining companies, contributing to their primary source of income. Key drivers include Geographe Enterprises, RCR, Piacentini, Monadelphous (Bunbury), WestTrac (Collie), and Iluka (Capel).

As noted above, many METS providers in the South West could also be classified as Advanced Manufacturing producers.

Case Study – Mineral Sands Mining in the South West

The two main mineral sands miners in the South West (and in Western Australia) are Iluka and Tronox, both of which have supply chains and vertical integration within the South West. Kemerton Mineral Sands and Doral are also present in the region.

Iluka's operations at Capel produce synthetic rutile manufactured from its ilmenite mineral sands mine at Tutunup South. The heavy metal concentrate is then taken by truck to the North Capel Processing Plant for treatment before being taken to the Bunbury port for exporting overseas.

Tronox mines ore is deposited in Wonnerup before it is run through a concentrator to produce heavy mineral concentrate (HMC) in Bunbury. Wonnerup is the 20th mine established by Tronox’s subsidiary Cable Sands Pty Ltd, which has been operating in WA’s South-West since 1956. The Wonnerup mine is the first of five mines Tronox has scheduled to come into operation and positions Tronox to continue to mine in the South West for the next two decades. Tronox also manufactures pigment at its facilities in Kemerton and Australind.

Image 2: Mining & Minerals - South West Development Commission.

Source: South West Development Commission website 2021.

Advanced Manufacturing

Advanced Manufacturing is the set of technology-based offerings, systems and processes that can add value across entire manufacturing supply chains. Advanced manufacturers are companies that create or adopt these technologies.

Industries most likely to apply Advanced Manufacturing techniques in the South West include manufacturing of mining and construction machinery, chemicals , IT and analytical instruments, heavy machinery, metal products, medical devices, plastics, textiles, and paint and coatings material.

The South West also hosts several other traditional manufacturing industries that can become advanced manufacturing with the right capabilities and support, particularly those that can integrate robotics and automation into their production systems, such as machinery and equipment manufacturing.

It should be noted that many advanced manufacturing industries in the South West produce products for / are part of other industry sectors, particularly Energy, Primary Industries, and Mining and METS.

Key enterprises driving the application of advanced manufacturing in the South West include Millennium Chemicals, BOC, Nufarm, Simcoa, Water Corp, Albemarle, Siemens.

Image 3: South West Advanced Manufacturing and Technology Hub.

Source: South West Development Commission website 2021.

Energy

The South West’s Energy sector includes companies in the energy supply chain for both heritage and emerging energy industries. Collie is currently Western Australia’s primary energy hub, with strong employment for both power generation and transmission; and coal mining. As a result, Collie is the centre of the South West Integrated System (SWIS), the state’s premier energy transmission and distribution network.

While it is anticipated the South West will host a number of emerging energy industries going forward (wind, solar, hydrogen, batteries), current data does not reflect these potential industries' location, scale, or characteristics. It should be noted that emerging industries such as hydrogen and battery manufacturing will be strongly interrelated with Advanced Manufacturing.

Key industry drivers of the energy sector in the South West include Western Power (SWIS); Synergy, Bluewaters (Collie); Alinta (Wagerup); Monadelphous, OFI Group (Bunbury); Transfield, Ratch (Kemerton).

Image 4: Collie Futures - South West Development Commission.

Source: South West Development Commission website 2021.

Creative & Digital Industries

The South West has an emerging reputation as the home of cutting-edge digital and creative technology firms which are competing in international markets across areas, including film making, post-production, visual arts, music and immersive technology innovations.

To define this sector, it is important to distinguish between activities that are simply creative or innovative and creative industries with firms whose core business is creative, ideation, culture or technology-based.

Based on consultation, the following creative industries have been identified as critical to the creative and digital industry sector in the South West: multi-media related to news production, gaming/coding, music and arts events, workshops, photo & videography, culture & arts.

The South West’s innovation hubs and co-working spaces help provide a supporting culture for these industries. As noted above, their outputs can often be digitally distributed. Creative & Digital Industries are less likely to cluster than the other industry sectors as they are less reliant on co-location. Noting this, key locations and drivers for the Creative Industries include:

Bunbury - BC, GWN, FIREY Productions, Little Jupiter, Intr.

Margaret River - Mix Tape, Emergence Creative Festival.

Dunsborough - Notable for its high numbers of firms specialising as photographers, creative artists, and musicians.

Image 5: Filming in the South West.

Source: Film South West website 2021.

STEEP Analysis (2021 Edition)

A STEEP analysis considers Social, Technological, Economic, Environmental, and Political trends and drivers of change. This structured approach has been used to identify potential opportunities and threats affecting the nominated industry sectors in the South West. In a fast-changing world important to recognise and track these factors, but also recognise that context changes rapidly.

In conducting the STEEP analysis, a number of cross-cutting themes that affect the strategic industry sectors have been identified and are explored below.

Figure 4: STEEP Drivers and Trends.

Source: FAR Lane 2021.

Social

The imperative of the Social License to Operate will continue to impact businesses, as community expectations regarding sustainability and carbon footprints increase. This will particularly impact the Mining & METS, and Energy sectors.

Shifts in Workforce and Skills will have large impacts on all industries. Many jobs of the future of the future will require highly skilled knowledgeable workers with niche areas of expertise. This specialisation will lead to higher wages and potential talent shortages, and require both training new workforce entrants and upskilling of existing workers. Advanced Manufacturing and METS will be particularly affected by these shifts.

Ways of Working are changing. Working from home and remote working will become normalised, meaning more jobs can be done from the South West that were not previously available. Sole traders in Creative & Technology Industries will continue to move to the South West in considerable numbers.

Implications

Industries will actively address their social license in light of community expectations.

Future workforce requirements need to be well understood, with regional initiatives proactive in addressing needs, particularly during times of high demand.

Workers will need to be upskilled for highly specialised roles. This may require access to knowledge, skills and experience not immediately available in the region.

More jobs will be able to be done remotely from the South West, particularly if digital connectivity, remote operations infrastructure and professional networks are made available.

Technological

Disruption is the new normal, as innovation becomes constant and ideas transform entire sectors. As a result, businesses will need to continually reinvent to keep pace with competitors, as new tools, equipment, and business models supplant old ones.

Existing technologies such as remote operations will become more entrenched but eventually be superseded by automation and robotics, reducing the need for low-skilled workers. Virtual Reality, Augmented Reality, and Extended Reality will create new jobs and products that link Creative & Digital Technologies Industries with Advanced Manufacturing, Energy, and Mining & METS.

Future regional competitiveness will be determined largely by the region’s ability to apply regional-specific knowhow to new technologies and opportunities.

New industries and solutions are emerging that will strongly impact the Energy sector. For example, battery manufacturing, green hydrogen, and large scale renewable plants will create cheaper, cleaner energy. This will unlock other new industries such as green steel.

Implications

Innovation and R&D will remain crucial for industries to avoid being disrupted.

Industry will have to embrace new technology continuously to avoid being bested by competitors.

New industries will provide opportunities for more jobs, growth and exports.

Fresh thinking from creative industries will be essential in unlocking new products, innovations and value in other sectors.

Economic

As global trade evolves, changing markets will impact all industries. The impacts of the COVID-19 pandemic will continue, with countries and businesses no longer willing to rely on just-in-time supply chains. Key products and industries will continue to be re-shored, providing opportunities for local business to being entering these supply chains. Combined with new technologies that reduce production costs, this represents an opportunity for regional Advanced Manufacturing firms to become globally competitive, even compared to overseas manufacturers with low labour costs.

The South West’s competitive advantages in METS products can be applied to challenges faced by overseas markets and boost exports of high-quality products and services.

The transition to net zero emissions will result in cheaper, cleaner energy, which will lead to new industries developing (see above). This will heavily impact Energy industries based on fossil fuels, noting that Collie’s Just Transition process is already underway.

Carbon tariffs applied by other nations (particularly the EU) will impact export-oriented fossil fuel intensive industries as their products become more expensive compared to those produced with clean energy.

Implications

The needs and expectations of customers for the South West's industries are changing rapidly.

Uptake of new technologies will allow some industries to become globally competitive and increase exports.

Some export industries that rely on fossil fuels will be impacted by overseas carbon tariffs, and will have to transition to renewables to remain competitive.

Environmental

The shift to sustainability and climate change action will significantly impact business operations, as industry react to changes to community expectations and begin to focus on triple bottom line results (i.e. social and environmental outcomes, as well as simply financial ones). This will significantly impact the Mining industry, and Energy industries based on fossil fuels.

New opportunities will also result from waste becoming inputs, and developing new clean and green products. The pace of capital investment and innovation will increase as economies and enterprises compete to develop solutions. These opportunities will continuously evolve, with those able to rapidly and effectively respond potentially benefiting from first mover advantages.

Implications

Industries will need to evaluate their sustainability constantly and environmental impacts as the world move towards net-zero emissions.

Climate change will also increase the number of extreme weather events which businesses will need to adapt to.

Need for the region, and individual enterprises, to continuously scan for trends in sustainable technological development and market expectations to identify opportunities and challenges that may impact future competitiveness.

Political

Geopolitical tensions are likely to continue to increase as new powers rise. This will lead to increases in defence spending and demand for sovereign capability as nations reduce their reliance on critical goods from overseas. This will create significant opportunities for Advanced Manufacturing and Creative & Digital Technologies to produce goods locally that are currently sourced elsewhere, particularly in the following fields:

Cybersecurity.

Robotics, Autonomous Systems, and Artificial Intelligence.

Information Warfare and Cyber Capabilities.

Medicines.

Agricultural production chemicals.

Implications

Industries will begin actively addressing their social license to operate in the eyes of community expectations.

Increased opportunities for manufacturing of products deemed critical by governments, including for defence and other industries such as medicines and agricultural production chemicals.