Powerful Pitching

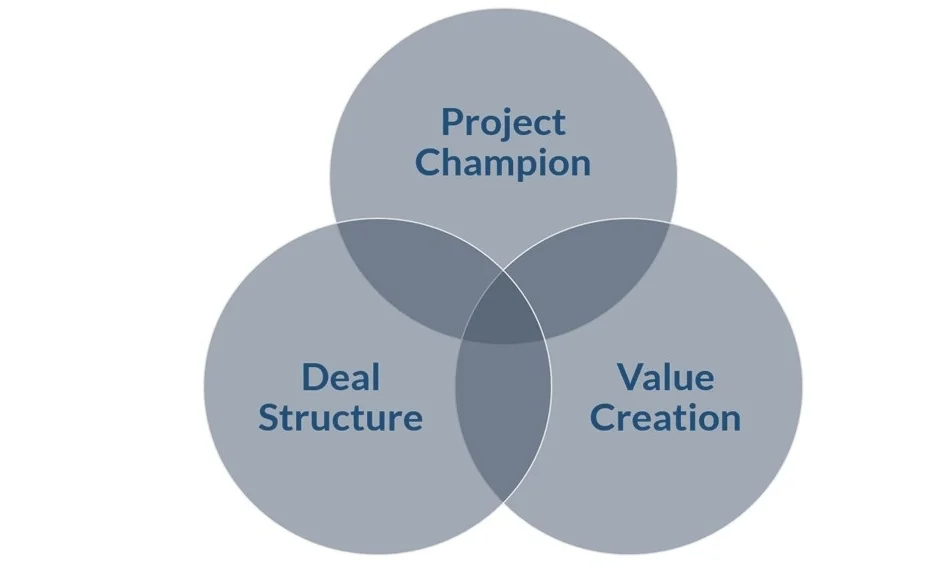

Recent experience in developing and assessing investment opportunities has given me cause for reflection on the key characteristics of a successful ‘pitch’. A quick search on Google provides an aspiring enterprise with any number of pitch deck templates, business plans and business case structures. Whatever the format, these can produce a colour-by-numbers outcome if the pitch is not accompanied by a deeper understanding of what is actually of interest to the targeted investors (be they private individuals, institutions such as banks or public investment agencies). We have found three core elements to be a common basis for strong investment pitches during recent work with both ventures and investors. We call this the Powerful Pitching model.

The Powerful Pitching Model

Source: FAR Lane (2016)

Strong projects almost always reflect deep consideration of each element, despite often dealing with each differently - reflecting the characteristics of the venture and specific interests of the investor. In doing so they answer a range questions from the perspective of the investor including considerations such as:

Project champions

· Who is going to drive this venture?

· How qualified and committed are they?

· What do the project champions uniquely bring to the venture?

· Where are there gaps in the team that need to be addressed?

Value Creation

· How does/will the venture create sustained value?

· What impact will the investment have on the venture's ability to create further value?

· How will this value be realised?

· What return will the investor potentially realise from this value creation?

Deal Structure

· What is being asked for, and what is being offered in return?

· How will the investor be able to realise the value created?

· How will the investor exit the venture?

A recent (and perhaps late) realisation of mine is that these elements are relevant right across the investment space, from public sector investment agencies to venture capitalists investing in start-ups. The table below describes some considerations around each element for three broad investment classes; venture capital, banks and public sector agencies.

Same Elements - Different Focus

Source: FAR Lane (2017)

At FAR Lane we use this simple model as a basis for a common language between the ventures and the investors. This supports ventures, including start-ups, growth enterprises and public infrastructure projects, in developing investor-oriented project pitches/business plans and/or business cases. It also supports investors by providing a concise framework to filter and assess ventures against their own individual investment criteria.

Finally, this model has been informative in the development of economic development strategies that are seeking to deliver real benefit to communities as it facilitates conversations as to where opportunities for intervention may best match the expectations of the investment community.